28+ Online tax return calculator

A new client is defined as an individual who did not use HR Block or Block Advisors office services to prepare his or her prior-year tax return. You purchased a duplex with an initial cash investment of 100000 and are projecting an annual gross rental income of 50000 4 vacancy 28 operating expenses and a debt service of 25000.

Thinkcar Thinkscan Max Obd2 Scanner Diagnotic Tool All System 28 Reset Functions Ebay

This puts you in the 25 tax bracket since thats the highest rate applied to any of your income.

. You can take your tax withheld and expand this out to capture the full year for entering into the tax calculator. Rates vary by school district city and county. Calculate your tax return quickly with our easy to use tax calculator.

Click here to see why you still need to file to get your Tax Refund. One mill is equal to 1 of tax for every 1000 in assessed value. These vary by county.

Property tax rates in Georgia can be described in mills which are equal to 1 of taxes for every 1000 in assessed value. On his Presidential campaign Senator Joe Biden proposed also imposing the payroll tax on every dollar of income above 400000. It is important to ensure that your ITR is processed to know if the tax department has accepted your income-related information.

The statewide exemption is 2000 but it applies only to the statewide property tax which is a relatively small slice of the overall property taxes in most areas. Filing taxes are usually done between the last week of January to April 15. This next calculator lets you try it out with your own numbers.

US Tax Calculator and alter the settings to match your tax return in 2022. US Tax Calculator and alter the settings to match your tax return in 2022. You declare anything youve earned from selling an asset over a certain threshold via a tax return.

Georgia Property Tax Rates. May not be combined with any other promotion including Free 1040EZ. Find out how to optimise the Travel Allowance section on your Tax Return for the Maximum Tax Deduction.

Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify. Offer valid for returns filed 512020 - 5312020. No Need to visit our office.

Here are the steps to follow for checking your ITR status. You want to know your cash on cash return. The value of a penalty unit is.

Operating expenses are computed as a percent of gross operating income for entries 1 - 100. Complete your own tax return online and have it checked by us. For example if you have had 8000 tax withheld to 28 th of Feb you can divide this by 8 months to work out your monthly earnings and times this by 12 months to capture the full year.

Ohio Property Tax Rates. Property tax rates in Ohio are expressed as millage rates. No cash value and void if transferred or where prohibited.

To prove you pay your fair share youre required to file a tax return annually to the Internal Revenue Service IRS. Because of the differences in assessed value described above millage rates in one county cannot be directly compared to another. This 72k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Kansas State Tax tables for 2022The 72k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Kansas is used for.

Please note this calculator is for the 2022 tax year which is due in April 17 2023. Capital Gains Tax is basically a tax that youre charged on money you make from selling an asset. Valid for an original 2019 personal income tax return for our Tax Pro Go service only.

On August 28 the IRS issued Notice 2020-65 which allowed employers to suspect witholding and paying Social Security payroll taxes for salaried employees earning under 104000 per year through the remainder of 2020. This fine is calculated at the rate of one penalty unit for each period of 28 days or part thereof that the document is overdue up to a maximum of five penalty units. But as a percentage of the whole 100000 your tax is about 17.

We offer calculators for the 2012 2013 2014. This 56k after tax salary example includes Federal and State Tax table information based on the 2022 Tax Tables and uses Alaska State Tax tables for 2022The 56k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Alaska is used for calculating. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office.

Use our Capital Gains Tax calculator to work out what tax you owe on your investment profits. Once the income tax return is filed by you the income tax department processes your return and is required to send you the intimation notice. FAQ Blog Calculators Students Logbook Contact LOGIN.

2

2

Payslip Templates 28 Free Printable Excel Word Formats Templates Professional Templates Excel

Xtool D7 Obd2 All Systems Diagnostic Scanner Key Programmer Abs Immo 28 Resets Ebay

Free 10 Online Receipt Samples In Ms Word Google Docs Google Sheets Ms Excel Pdf

Total Debt Service Ratio Explanation And Examples With Excel Template

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

Thinkcar Thinktool Pro Car Full System Obd2 Diagnostic Scanner Ecu Coding Tool Ebay

In Flight Usa November 2019 By Anne Dobbins Issuu

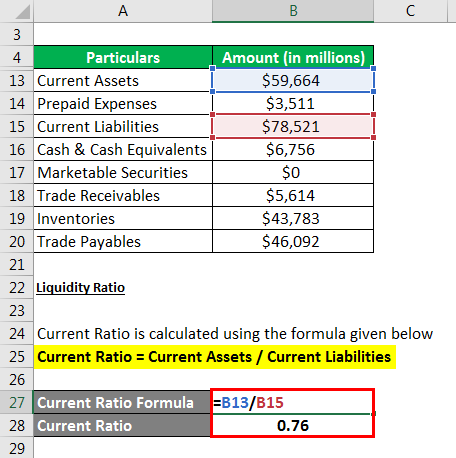

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Purchase Requisition Form Templates 10 Free Xlsx Doc Pdf Formats College Application Essay Templates Excel Templates

Autel Mx808 Maxicheck Scanner All System Diagnostic Service Tool Obdprice Eu

2

2

Thinktool Mini Bidirectional Obd2 Scanner Ecu Coding Active Test Diagnostic Tool 98841574064 Ebay

Illinois Appraisal Continuing Education License Renewal Mckissock Learning

Business Cards For Students Student Business Card Request Survey Student Business Cards Student School Of Education